Fit for e-Invoicing

with QAD

Our e-InvoSys service brings you to digital invoice processing simply, reliably, and securely.

The future of

invoicing is digital

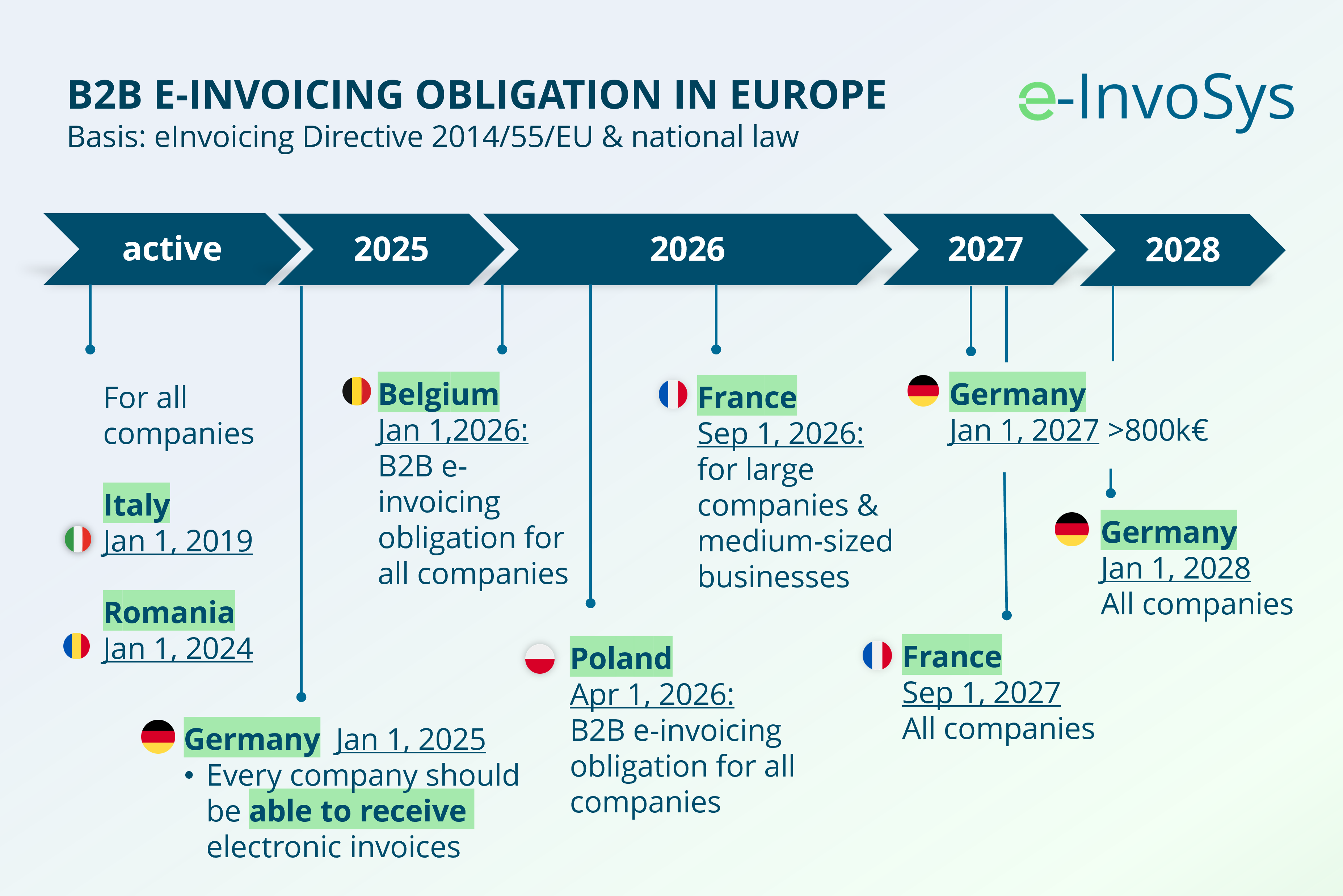

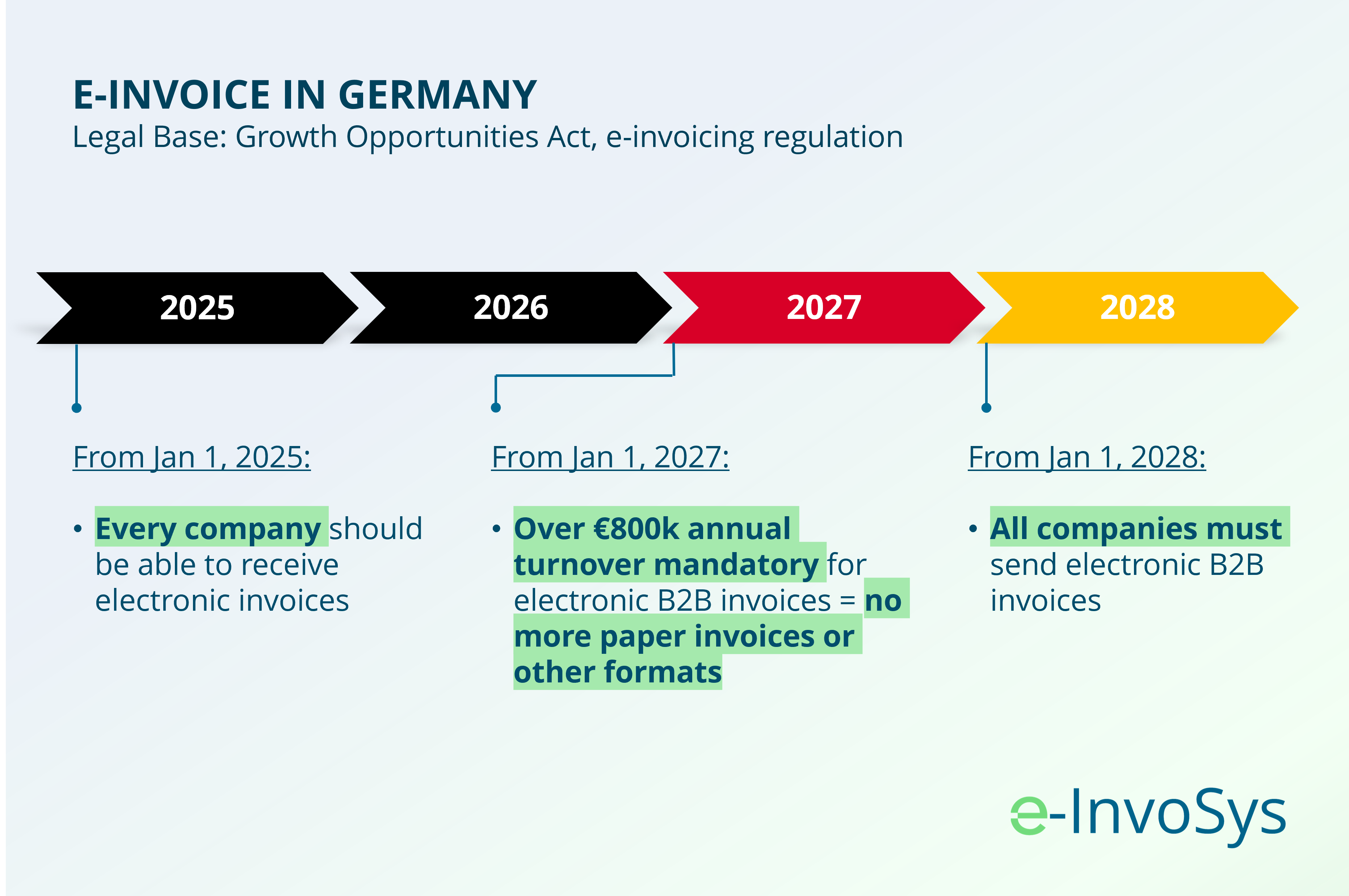

On January 1, 2025, the phased e-invoicing obligation for companies in Germany began. In many other European countries, this is already fully in effect or will follow shortly. With the QAD-compatible e-invoicing service e-InvoSys from Kontext-e, the certified sales partner of QAD in the german-speaking region, Benelux, and the Baltic states, you ensure that your invoicing processes comply with legal requirements—efficiently, automated, and completely secure.

Implementing the e-Invoicing obligation?

e-InvoSys is the smart solution for companies that want to digitize and optimize their invoicing. Our cloud-based service enables the seamless sending and receiving of e-invoices in legally compliant formats, including XRechnung, ZUGFeRD, Peppol BIS, and UBL.

Easily with e-InvoSys for QAD ERP:

Seamlessly Integrated

Perfect interface connection to QAD ERP and other ERP systems.

Automation Saves Time

Less manual work through digital workflows and process automation.

Focus on Legal Compliance

Create and receive e-invoices in accordance with legal regulations.

Archiving – Secure and Accurate

Audit-proof storage of your invoices for at least 10 years.

Easy Cost Savings

Reduce effort and sources of error through digital invoicing processes.

User-Friendly & Multilingual

Intuitive operation via a modern web interface, available in German, English, Dutch, Turkish, and other languages.

Overview of Functions

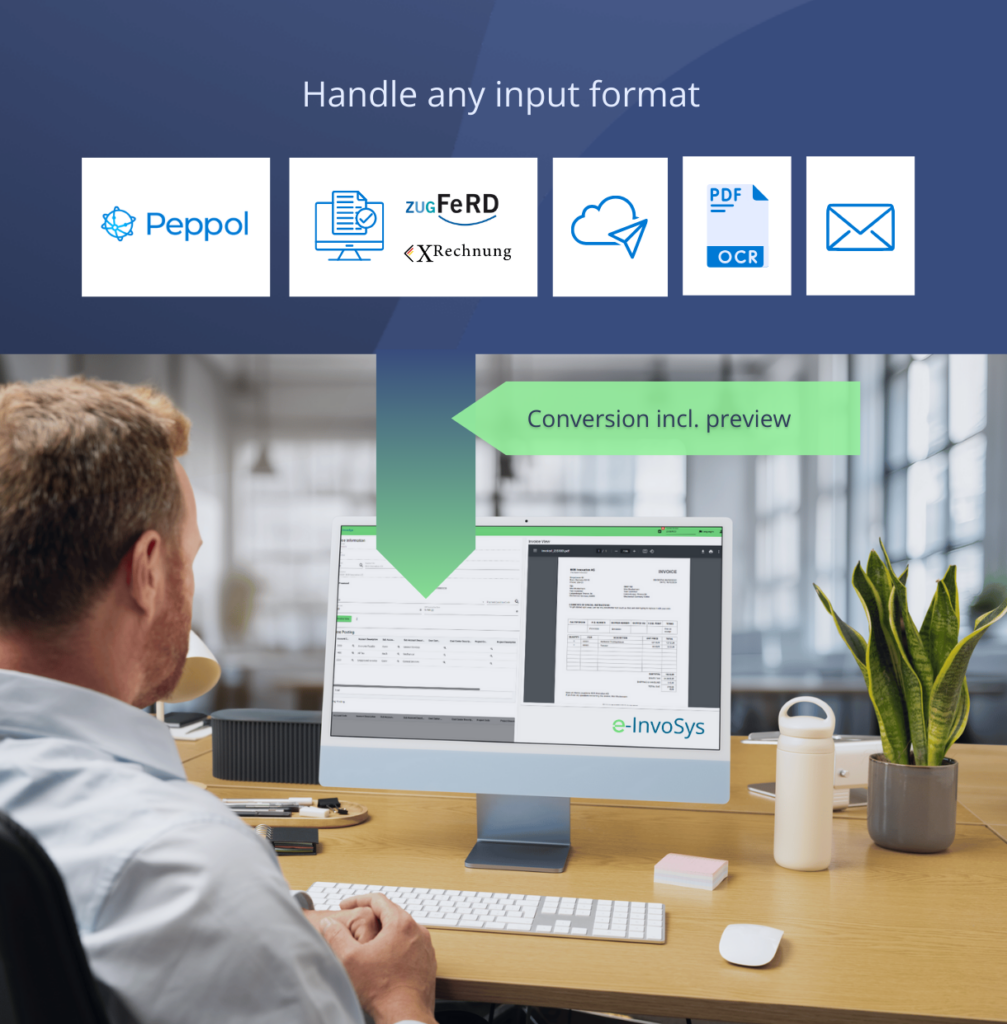

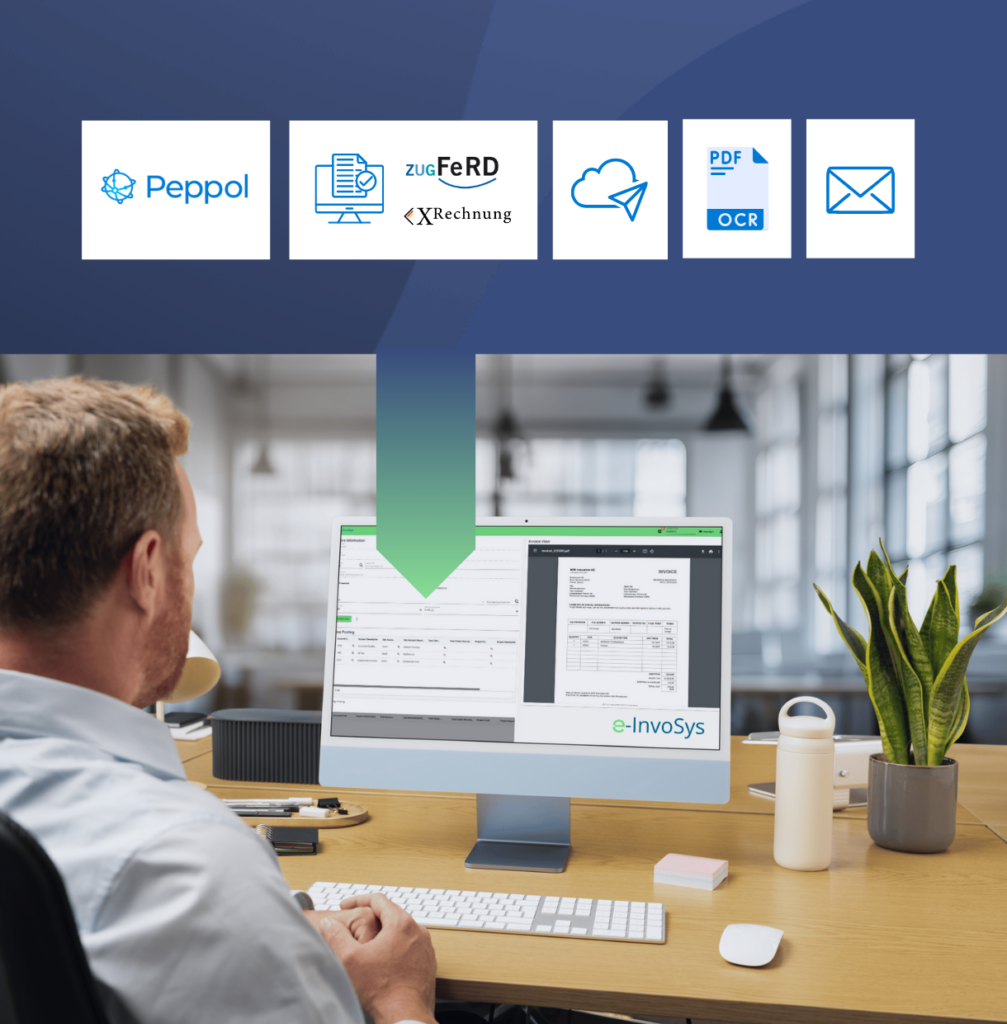

e-InvoSys accompanies you seamlessly throughout the entire process from invoice receipt to invoice processing to your own invoice dispatch. This keeps you flexible regardless of which format you receive or want to send as an invoice.

Let our demo convince you:

Invoice receipt

Receiving and Sending E-Invoices

Possible in formats such as XRechnung, ZUGFeRD, UBL, Peppol BIS, and globally common formats.

Receiving Invoices in PDF Format

Extracting invoice information via OCR with subsequent validation of the data.

Receiving Paper Invoices

Scan your paper invoice and send it to e-InvoSys; from here, the OCR takes over to read the data.

Minimise error susceptibility

Maximise efficiency, minimise errors with e-InvoSys for your incoming invoices.

Invoice processing

3-way matching for seamless data networking

Comparison of the data read out via OCR or the e-invoice with existing information from the ERP, such as incoming goods postings and purchase order items (3-way matching)

Approvals & authorisations

Flexible, multi-stage approval process within e-Invosys and posting directly in QAD upon approval. No more manual posting necessary - automate your invoice receipt process and avoid errors.

Transparent auditing

The integrated approval processes also help you to ensure transparent invoice verification.

Invoices and expenses without order reference

Processing of incoming invoices/expenses/documents without a purchase order reference through intelligent recognition of relevant data as well as automatic validation against master data and flexible workflows for checking and approval.

Sending invoices

Automatic conversion

The automatic conversion & validation of your invoices into the required e-invoice format supports your users so that no changes need to be made to your outgoing invoices.

Still PDF ready

Continue to send PDF invoices to customers who want them - no problem with e-InvoSys!

Prioritizing safety

Secure transmission via PEPPOL and other official channels.

Track real-time status

Dashboard & reporting for real-time monitoring of all invoices.

Any unanswered questions?

Perfect for companies of any size

Regardless of whether you are an SME or a large company – e-InvoSys adapts to your needs and can be flexibly integrated into your existing processes.

Start now

Prepare for the changeover in good time and benefit from the advantages of digital invoicing. Contact us for a non-binding consultation or request a demo of e-InvoSys!

Christopher Kube

Lead Sales & Presales

Zufriedene Kunden

Vitesco Technologies Emitec GmbH

Design and maintenance of an Industry 4.0 application for drive technology from Lohmar

APCB – Automotive Plastic Components Berlin GmbH & Co KG

Introducing QAD ERP in the Cloud for a major player in the automotive supplier industry

MAUSER Packaging Solutions AG

Worldwide introduction of QAD ERP for a global market leader in the packaging industry

FAQ on the e-invoice

Here we answer the most frequently asked questions about e-billing – in a compact and understandable way. We will be happy to provide you with further information or personalised advice.

When will e-invoicing be mandatory?

This depends on where your company is based and the markets in which you operate. In Germany, for example, every company must be able to receive e-invoices from 1 January 2025. We have summarised more on this in the first section of this page in a timeline for Germany and other European countries.

What is an e-invoice? Is an invoice as a PDF or by e-mail also an e-invoice?

An electronic invoice is an electronic document with the same content and the same legal consequences as an invoice in paper form.

In Germany, for example, formats such as XRechnung and ZUGFeRD are used, which are established standards for electronic invoices. This means that invoices in PDF format or by email are certainly digital invoices, but not e-invoices.

An e-invoice must be issued, transmitted and received in a structured electronic format in order to enable automatic and electronic processing of the document.

What advantages does the e-invoice offer?

In addition to the well-known advantages such as cost savings and a more efficient invoicing process, e-invoices offer further benefits such as improved traceability, increased security and sustainability.

Better traceability and transparency

- Digital processes make it easier to track invoices, call up status updates in real time and automatically monitor payment deadlines.

Faster payment processing

- As invoices can be sent digitally and processed automatically immediately, payment cycles are shortened and liquidity planning is improved.

- Smooth processing without media discontinuity

- Automated checks

Increased security and less risk of fraud

- Electronic invoices are more forgery-proof than paper invoices and offer additional protection against fraud through signatures or certificates.

- Transmission errors can be avoided by using e-invoices.

International compatibility

- E-invoices are increasingly becoming the standard in many countries, meaning that companies that operate internationally benefit from simpler processing.

Sustainability

- By eliminating paper, printing and physical dispatch, companies reduce their ecological footprint and contribute to sustainability.

How do I create an e- invoice? How can I receive an e- invoice?

An e-invoice can be quickly received, created or sent using e-invoicing software and/or an ERP system, such as QAD ERP and e-InvoSys, which are suitable for small to large companies.

Such systems automatically take into account the steps of validating and converting invoice data into an e-invoice and offer you the option of integrated invoice dispatch and archiving in accordance with statutory invoice regulations.

e-InfoSys includes all this securely and easily.

Do you have any unanswered questions?